Suggested Search

-

Customer login

The chance to utilise some unused carry-forward contributions and minimise your tax bill runs out for the first time on 30 June 2024. Taking advantage of these and other smart ways to boost your super this financial year could help you maximise your tax savings and get those happy feels now, as well as when you retire.

Significant tax concessions are available on super to encourage people to contribute so they have more money available in retirement. Following are some smart ways you may be able to use your super to get ahead before 30 June 2024.

Pre-tax contributions, caps, and carry-forward amounts

Pre-tax contributions, also known as concessional contributions, are payments made into your super from your pre-tax income. They include compulsory employer contributions, voluntary pre-tax contributions such as salary sacrifice, and personal deductible contributions.

They reduce your taxable income and are generally taxed at a maximum of 15%*, which is lower than the personal marginal tax rate most people pay.

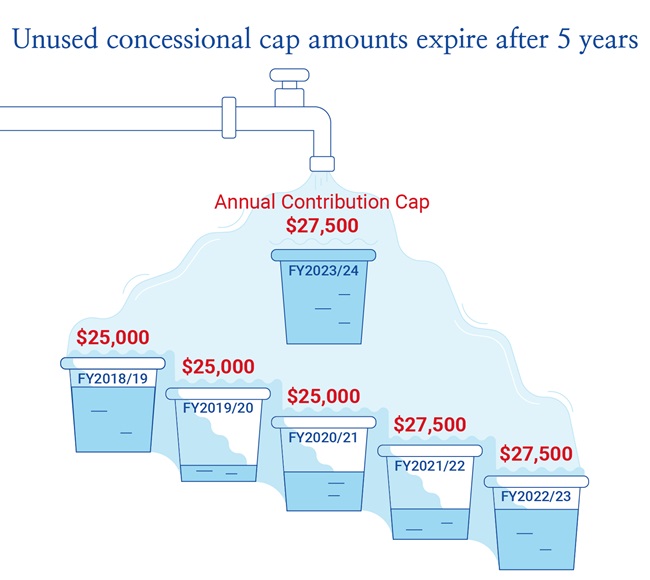

You can contribute up to a limit, or cap, of $27,500 in 2023-24 – or potentially more if you have not contributed up to your cap in any of the previous 5 years under what’s known as the ‘carry-forward rule’.

Last chance to catch-up on carry-forward amounts from 2018-19

The carry-forward rule was introduced in 2018-19 to enable people who may have spent time out of the workforce or working part-time to ‘catch up’ on years when they may not have accumulated much super.

If you have not fully utilised your annual concessional cap in the last five financial years, you may be able to carry-forward the unused amounts to the current financial year to allow you to make a larger concessional contribution.

There is a five-year time-limit to make catch-up pre-tax contributions and the first of these is about to expire.

Unused carry-forward concessional contributions from 2018-19 must be used by 30 June 2024.

It’s important to note that this strategy is not for everyone. To be able to use the carry-forward rule, your total super balance at the previous 30 June must be less than $500,000, and for this strategy to be effective you need to have sufficient taxable income†.

You can find out how you’re tracking against these caps, and whether you have unused contribution cap amounts by logging onto myGov at my.gov.au. From 1 July, the super guarantee rate, or compulsory percentage of your earnings your employer pays into your super account, goes up from 11% to 11.5%. The annual concessional contributions cap will also increase to $30,000.

Stage 3 tax cuts

All Australian taxpayers will be paying less tax from 1 July 2024 under the Stage 3 tax cuts that kick in on 1 July. And if you invest even a portion of those tax savings into your super, you could be significantly further ahead without feeling the pain of saving. The tax benefits of having this money in the super system, where earnings are taxed at a maximum of 15%, mean it compounds faster over time.

$30,000

$1,542

$1,188

$354

$45,000

$4,767

$3,963

$804

$70,000

$13,217

$11,788

$1,429

$100,000

$22,967

$20,788

$2,179

$150,000

$40,567

$36,838

$3,729

$190,000

$56,167

$51,638

$4,529

Note, these amounts do not include Medicare levy.

Super, non-super or home loan?

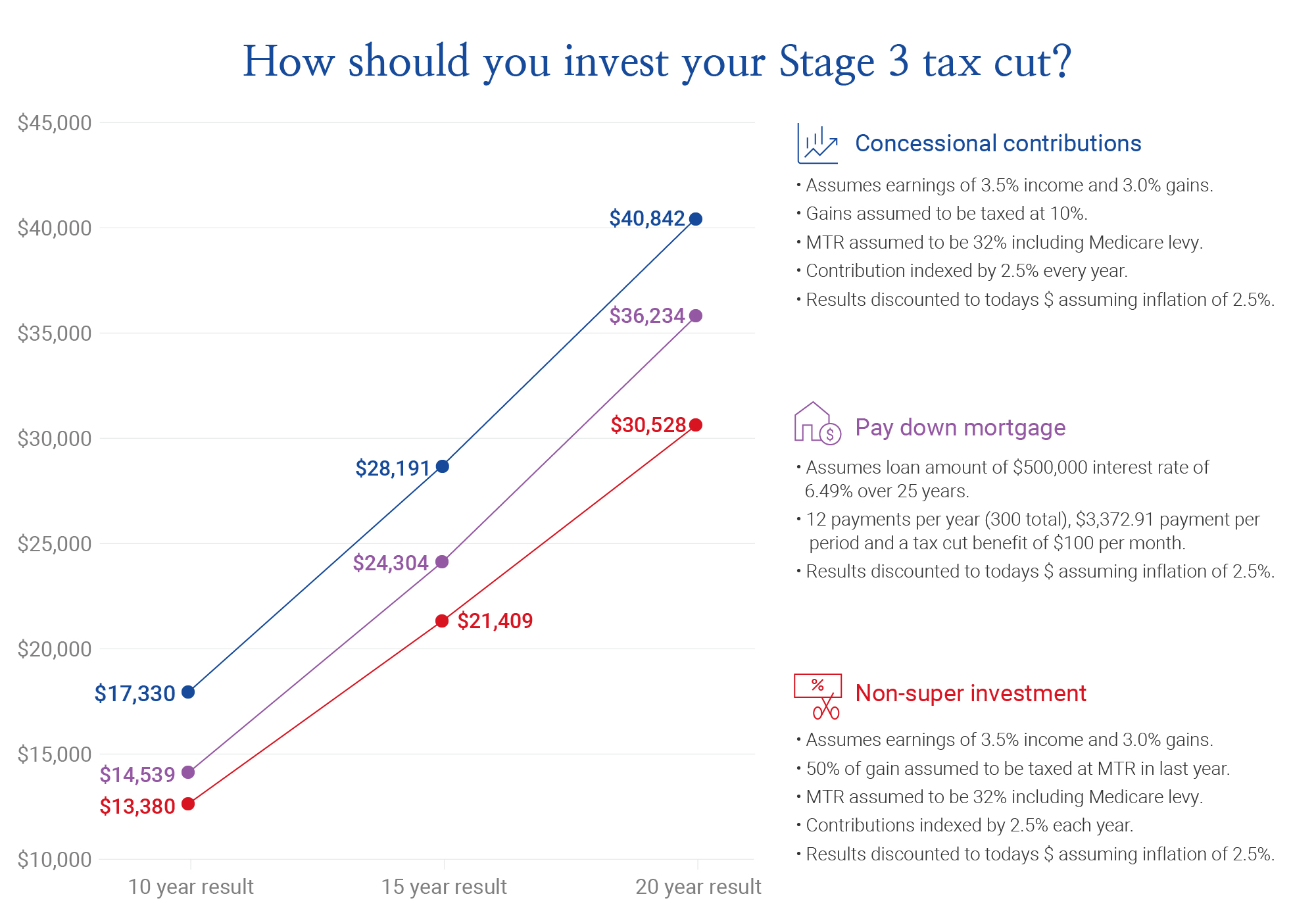

CFS has calculated the estimated benefits of putting some of the tax cuts into super as concessional contributions, compared with paying down your home loan, and investing outside the super system.

It shows the tax advantages of investing even a small amount into super on a regular basis, which could put you thousands of dollars ahead over time.

The following chart shows the indicative benefit for someone earning $100,000 a year who invests just over half their tax cut (approximately $1200 a year) into super as a concessional contribution, based on the assumptions specified:

It's important to note that there are a number of considerations when deciding which investment option is right for you. For example, money invested in the super environment is generally not accessible until you retire, whereas money invested in non-super investments or a mortgage offset account may be accessible.

Salary sacrifice

At your request, your employer can make additional contributions to your super using pre-tax money before it gets to your pay packet. This is generally taxed at 15%‡ and may provide a significant tax saving if your marginal tax rate is higher than 15%. There are some limits, but you can usually salary sacrifice into super if you are under 75 at the time of the contribution.

Personal deductible contributions

You may be able to make a personal contribution to your super fund and claim a tax deduction for it.C ontributions that you claim a tax-deduction for are generally taxed at 15%‡ within your super fund.

Personal deductible contributions can be made throughout the year, or at the end of the financial year when you might have a clearer picture of what your taxable income will be and how much you should claim as a tax deduction.

How does it work?

There are some rules around making personal deductible contributions, and if you’re aged between 67 and 74 you need to meet a work test (or work test exemption) to qualify.

To claim this tax time, you need to:

- have made a personal contribution to your super either as a one-off or regular payment in 2023-24 financial year,

- lodge a valid notice of intent form with your super fund before you lodge your tax return – or before the end of 2024-25 financial year (if that’s earlier),

- receive an acknowledgement from your fund in writing,

- finalise your tax return using the contribution amount included on your notice of intent.

It’s worth checking with an adviser to ensure it’s the right strategy for you and you’ve met all the conditions to qualify.

To ensure that you can submit a valid notice of intent form for all of your personal contributions, you also need to ensure it is lodged with your super fund before any withdrawals or rollovers are made, or income streams are commenced, from your super account.

Non-concessional contributions

You may also wish to consider making non-concessional, or after-tax, contributions to your super.

They are different to concessional contributions as they are not taxed when you contribute them to super, and you don't receive a tax deduction for making the contributions.

However there are a number of advantages to making non-concessional contributions, such as moving your money into the tax effective super environment where any earnings you make only attract a maximum 15% tax.

How does it work?

There’s an annual limit of $110,000 on after-tax contributions to super in 2023/24.

What’s the bring-forward rule?

Under the bring-forward rule, you may be able to bring forward the cap amounts for the next two financial years into the current financial year, depending on your total super balance.§

This means you could contribute up to $330,000 to your super this year under this rule. On 1 July, the annual limit on after-tax contributions to super will increase to $120,000. This means that under the bring forward rule, you could contribute up to $360,000 in 2024/25.§

After-tax spouse contributions

A spouse contribution is when you add some of your after-tax income to your spouse’s account as a super contribution.

Making a spouse contribution may be a good idea this financial year if one of you has a lower super balance than the other as it can help even up the super balances.

In addition, the contributing spouse may be eligible for the spouse contribution tax offset of up to $540.>

Whichever super contribution strategy you choose, it’s important to consider your own personal financial situation and seek advice to ensure it’s the best option for you.

What’s next?

Keen to invest some of your Stage 3 tax cuts?

Stage 3 tax cuts to invest? Learn how different investment options stack up.

How much super should

I have?

It’s the number one question members ask. We guide you through the basics.

Personalised, affordable advice online

Australians who get financial advice are more likely to enjoy retirement.

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

*For high income earners, an additional 15% tax may be payable where a member’s income for a financial year exceeds $250,000. For low income earners, contributions tax up to $500 may be refunded if you earn less than $37,000.

†When making a concessional contribution using the carry-forward rules, you need to have sufficient taxable income to offset with a personal tax-deductible contribution or salary sacrifice. You should also keep your tax-free threshold in mind, taking into account any tax offsets you may be eligible for.

‡For high income earners, an additional 15% tax may be payable where a member’s income for a financial year exceeds $250,000. For low income earners, contributions tax up to $500 may be refunded if you earn less than $37,000.

§Your non-concessional cap reduces to nil once your total super balance is $1.9 million or more. For 2023/24, the cap you have available under the bring forward rule will reduce once your total super balance is $1.68 million or more. For 2024/25, the cap you have available under the bring forward rule will reduce once your total super balance is $1.66 million or more.

>A spouse contribution tax offset of $540 applies if your spouse earns less than $37,000. To get the full tax offset, you need to contribute at least $3,000. This offset decreases if your spouse’s income exceeds $37,000 and phases out completely at $40,000.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products.

This document may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit.

You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.