Suggested Search

How do Australia’s more than four million retirees spend, manage and feel about their retirement savings? New research* from CFS reveals some hidden truths you may be surprised to learn about your fellow retirees.

Australian retirees have been living with high inflation for several years, characterised by higher interest rates, increased living costs and weak economic growth. So how are you feeling about retirement?

The cost of living remains a chief concern for all Australians, and it’s the biggest worry for two in three retirees, according to new research about retirement* commissioned by CFS.

Our research reveals some hidden truths you may be surprised to know about your fellow retirees.

1. What makes a comfortable retirement?

How do Australians generally define what makes for a comfortable retirement?

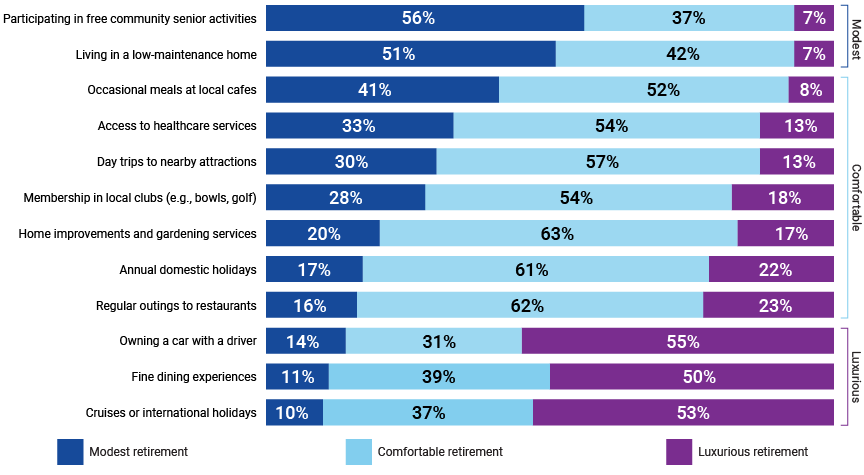

The picture that emerged from our research includes being able to eat out regularly, perhaps at restaurants rather than the local café, taking day trips to nearby attractions rather than being limited to free community activities, and being able to take a holiday in Australia – at least annually.

What does a comfortable retirement look like?

Percentage of Australians who consider this activity part of a comfortable retirement

How much income do older Australians generally say is needed to achieve this?

Those aged 65-74 most commonly say the average annual household income needed to achieve a comfortable retirement is somewhere between $52,000 and $99,000.

This is very close to the minimum standard for a comfortable retirement of $51,814* for a single and $73,031 for a couple, as defined by the Association of Superannuation Funds of Australia.

However, these figures assume home ownership and a part-Age Pension. And we know many retirees don’t apply for the Age Pension as soon as they’re eligible, losing out on a potential source of income that could make them more comfortable in retirement.

Things to consider:

Are you getting what you’re entitled to? Learn more about the Age Pension or check your eligibility.

While you’re at it, check you’re not making any of these other common retirement mistakes.

2. One in four retirees are still paying off debt

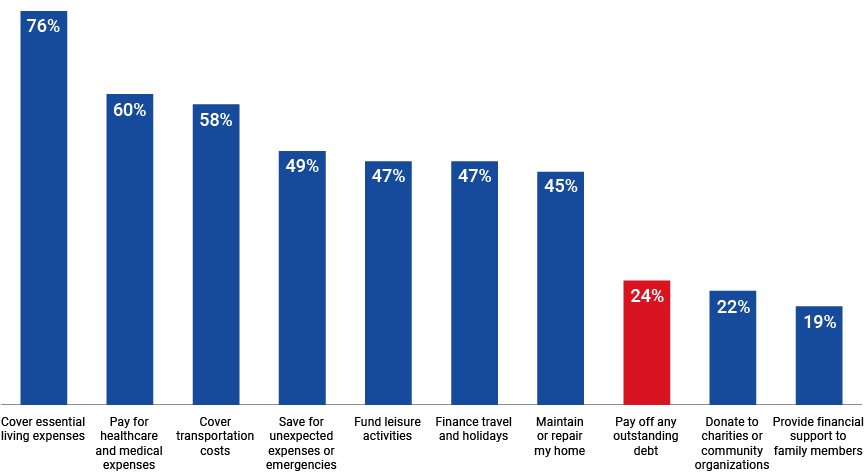

How do retirees spend their money? Most often, it’s on essential living expenses, followed by healthcare and medical, and transportation costs

Saving for unexpected emergencies edges out spending on leisure activities, holidays and home repairs, reflecting many retirees’ worry about potentially running out of money.

And almost one in four Australians who have already retired are still using their pension to pay off debt.

How retirees spend their pension payments

Among those aged 65-74, the average amount of debt is $100,000. For those above 75, the figure drops to $20,000.

Older Australians who get off-track financially are least likely to seek financial advice, with just one in four saying they would do so.

Things to consider:

The government’s Moneysmart website offers advice to help Australians of any age to manage debt, including offering financial counselling.

It’s also important to pay close attention to how your super is invested early in retirement. While it’s generally accepted you should start reducing risk in the lead up to and entering retirement, being invested too conservatively could end up costing you in the long run.

Log into your account to find out the risk profile and return of your investment options.

3. Older retirees are generally happier retirees

Contrary to what some might expect, how people feel about retirement generally improves with age.

Cost pressures are felt more keenly by those aged between 65 and 74, while Australians aged over 75 are more likely to say a comfortable retirement is possible.

Overall, two in three retirees say they are currently able to enjoy a comfortable retirement.

Those who have never obtained financial advice, or who don’t own their own home are more likely to be worried about running out of money.

Things to consider:

It’s never too late to take steps to plan for your retirement. Learn more about the financial considerations that may be open to you – including tax-saving strategies, income stream options and estate planning – on our Retirement Hub.

4. Feeling unprepared may not end when you retire

One in five Australians who have retired feels unprepared for retirement.

How you manage your finances is critical to good long-term retirement outcomes, but retiring is about more than money.

“No one is prepared to retire emotionally,” one retiree said.

Things to consider:

No matter how far into your retirement you are, it’s important to take a holistic approach to your retirement planning, encompassing things like:

- sense of purpose

- wellness

- social and community connection.

Consider pursuing a passion project, or volunteering in some way.

When it comes to wellness, the Australian government provides guidelines on physical activity for older Australians, as well as diet and how to look after your mental health. A good place to start may be talking to your GP.

5. Financial advice can make a big difference to outcomes and confidence

The positive effect of financial advice on retirement preparedness is clear: almost nine in ten advised Australians feel they are on track to reach their retirement goals compared with less than half who have never received advice.

Those who do receive advice are significantly better off, and are:

- Twice as likely to know how their super is invested

- Much more likely to say they are on track to achieve their retirement goals

- Twice as likely to feel financially prepared for retirement

- Twice as likely to retire at a time of their choosing.

Did you know?

Our customer guidance team offers members free consultations to help you maximise your retirement outcomes no matter what age or stage you're at. Book a call if you would like to speak to one of our consultants.

What’s next?

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

* Rethinking Retirement report 2025 and 2024, commissioned by CFS, for which more than 2247 Australians were surveyed about their attitudes to retirement and retirement savings during January-March and July-September 2024.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. This document may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.