Suggested Search

Most investment markets generated strong growth over the 12 months to 31 December – but why? And will we see the same in 2025? CFS Chief Investment Officer Jonathan Armitage explains some of the drivers of that growth and what investors may expect as we head into 2025.

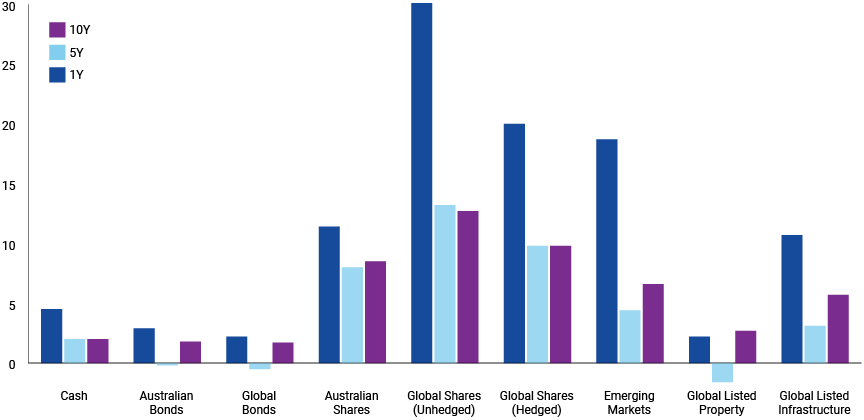

For many investors, 2024 was an exhilarating time to be in the market, with many asset types generating returns well above their 10-year average.

However, against the background of a higher-inflation environment, market volatility is increasing and the returns offered by different investment types can change quickly.

Global stocks, led by technology companies fuelled by the obsession with generative AI, were the poster child for growth. However, Australian shares and emerging markets also performed strongly, according to data for the 2024 calendar year compiled by CFS*.

Global shares set the pace

Global shares, particularly unhedged shares, led the charge with impressive returns of 30.1% over the 12 months to 31 December 2024. This remarkable performance outstripped the near-20% growth they offered in the financial year to 30 June 2024, and more than doubled their 10-year average return of 12.7%.

The driving force behind these stellar results was US tech stocks and the rapidly expanding AI sector. The ‘Magnificent Seven’ technology firms – which includes Nvidia, Microsoft, Alphabet, and Meta and others – played key roles in the boom, but growth broadened beyond these titans to include other parts of the market, such as small companies, according to CFS Chief Investment Officer Jonathan Armitage.

“Nvidia, at the heart of this whole AI boom, has seen its valuation skyrocket from $300 billion to now $3.5 trillion in two years, which is the equivalent of 12 or 13 Commonwealth Banks,” Jonathan said.

Hedged global shares, which minimise the impact of currency fluctuations, continued to perform robustly, returning 20.0%.

CFS is expecting US earnings to remain strong, but lofty valuations combined with high market expectations regarding the benefits of AI may result in shorter-term challenges.

“There remains significant spend related to AI, but there are also higher expectations from investors around return on investment. We expect to see a continued broadening of performance with the gap between the Magnificent Seven and the rest of the market narrowing."

This has been highlighted recently with the launch of DeepSeek, a new AI model developed at a fraction of the cost and more efficient energy usage than alternatives.

Returns by investment type over 1, 5 and 10 years

* Source: Benchmark performance is shown for: Bloomberg AusBond Bank Bill Index; Bloomberg AusBond Composite 0+ Yr Index; Bloomberg Global Aggregate AUD Hedged; S&P/ASX 300 Accumulation Index; MSCI AC World ex Aust Custom Tax Index AUD Net; MSCI ACWI ex Aus Custom Tax Net Index AUD Hdg, MSCI Emerging Markets (AUD), FTSE EPRA/NAREIT Dev ex Aus Rental Index AUD Hdg Net and FTSE Dev Core Infrastructure Index AUD Hdg Net.

Australian shares remain solid

Australian shares also enjoyed a strong year, returning 11.4% – significantly exceeding their 8.5% average return over the past decade.

However, high valuations for banks, which are priced above their global peers and historical averages, could be a concern for Australian equities moving into 2025.

“Given the significance of the banking sector to the Australian share market, it will be a key driver of returns,” Jonathan said.

Emerging markets bounce back

Emerging markets rebounded strongly, offering returns of 18.7% over the calendar year – almost three times their 10-year average.

CFS has been looking to expand investments in markets such as South Korea, China, and Taiwan.

However, China could be “in the crosshairs” of future Trump administration economic policy, such as possible tariffs, although details remain unclear.

Fixed income navigates inflationary pressures

Australian bonds returned 2.9% over the 2024 calendar year, well up on their 10-year average 1.8% return. Global bonds saw a return of 2.2%, which also topped its average 1.7% performance over the past decade.

“Inflation remains persistently high in many markets and is likely to be more variable than in the last decade,” Jonathan said. “This is reflected in continued interest rate volatility in developed market economies.

“However, divergence is emerging across both developed and emerging market economies, leading to opportunities in interest rates and currencies.”

Cash continues to benefit

Cash benefited from higher interest rates, despite a higher inflation environment driving up the cost of living in developed markets such as Australia. It returned 4.5% over the course of 2024, which was more than double its 10-year average of 2.0%.

“We think underlying inflationary pressures are going to continue to be a feature of markets going forward,” Jonathan said.

Higher yields and strong US economy supports investment in credit markets

Corporate bond spreads “remain tight by historic standards”, Jonathan said, while “higher all-in yields and continued strength in the US economy remain supportive of investment in credit markets”.

“Opportunities in asset-backed and opportunistic credit continue to grow, in line with the disintermediation of core bank lending that has occurred in the last few years.”

High-yield credit and private debt could become increasingly attractive if shares begin to pull back significantly.

Opportunities arise in quality global listed infrastructure

Global listed infrastructure returned 10.7% last year, reflecting a more active market in 2024 and generating almost twice its average 10-year return. Returns were driven by US energy related names benefitting from the AI buildout. This evolution will present opportunities in both listed and unlisted infrastructure.

“We expect to see opportunity for patient capital to acquire quality assets moving forward,” Jonathan said.

Global listed property trails other sectors

Global listed property returned a modest 2.2% over the past year, although this has dipped in recent months, and trails the sector’s 2.7% 10-year average return.

CFS considers listed industrial property to be fully priced and remains cautious about assets that do not exhibit strong demand fundamentals. Retail and office asset valuations have also faced headwinds in recent years, but high-quality assets “continue to show strong resilience”.

What should I do if I’m concerned about my investments?

CFS offers a range of investment products to suit your investment needs, whatever investment type you’re interested in. Learn more about investing with CFS.

Learn more on our website. If you'd like help with your investment strategy, book a free consultation with our guidance team.

What’s next?

Investing made simple

Learn everything you need to know to plan and starrt your investing journey.

Investment options

Learn about the different types of investments you can make, and which might be right for you.

Investment glossary

Get your head around about common financial and investment terms with our A-Z jargon buster.

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

* Benchmark performance is shown for: Bloomberg AusBond Bank Bill Index; Bloomberg AusBond Composite 0+ Yr Index; Bloomberg Global Aggregate AUD Hedged; S&P/ASX 300 Accumulation Index; MSCI AC World ex Aust Custom Tax Index AUD Net; MSCI ACWI ex Aus Custom Tax Net Index AUD Hdg, MSCI Emerging Markets (AUD), FTSE EPRA/NAREIT Dev ex Aus Rental Index AUD Hdg Net and FTSE Dev Core Infrastructure Index AUD Hdg Net.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. This document may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.