Suggested Search

Dramatic movements in global financial markets this week saw investors react and commentators predict a US recession. We unpack what happened and how the CFS Investment team is positioned for these market bumps.

On 5 August 2024, the Japanese stock market plunged and seemingly caused a significant ripple effect across global markets including Australia.

So how are your super and investments affected during times like these? It’s a good time to remember that while markets go up and down in the short term, in the long run markets bounce back.

Here’s what you need to know.

What led to this?

It wasn’t one factor, but a number of factors that set off this roller coaster ride.

Last week, the US market started to slide with the release of some economic data and earnings reports.

On the economic front, a US employment report showed unemployment had risen, with job positions declining. Some read this as a slowdown in the economy which drove concerns of a US recession.

On top of this, tech and media company earnings disappointed investors. Some investors expected the significant spending on artificial intelligence and the associated benefits would drive greater earnings. Ultimately, this meant US earnings did not meet expectations, adding to further predictions of an economic downturn.

At the same time, the Japanese Yen strengthened after a second increase in interest rates. There had been widespread trading activity where investors borrowed Yen at a cheap rate and invested in shares and assets outside of Japan. So, there was a large volume of investors selling shares which shook global markets and drove down share prices.

At CFS, we believe the prediction of a US recession is premature. One week’s employment data isn’t a strong indicator of economic downturn. Also, the Federal Reserve also has the option to reduce interest rates to ease economic pressure.

What does this mean for me?

This week’s events were significant. However, it’s a good reminder to stay focused on your long-term investment strategy instead of reacting to short term events.

To further illustrate how quickly things change, a day after Japan stocks plunged, its share market rebounded strongly.

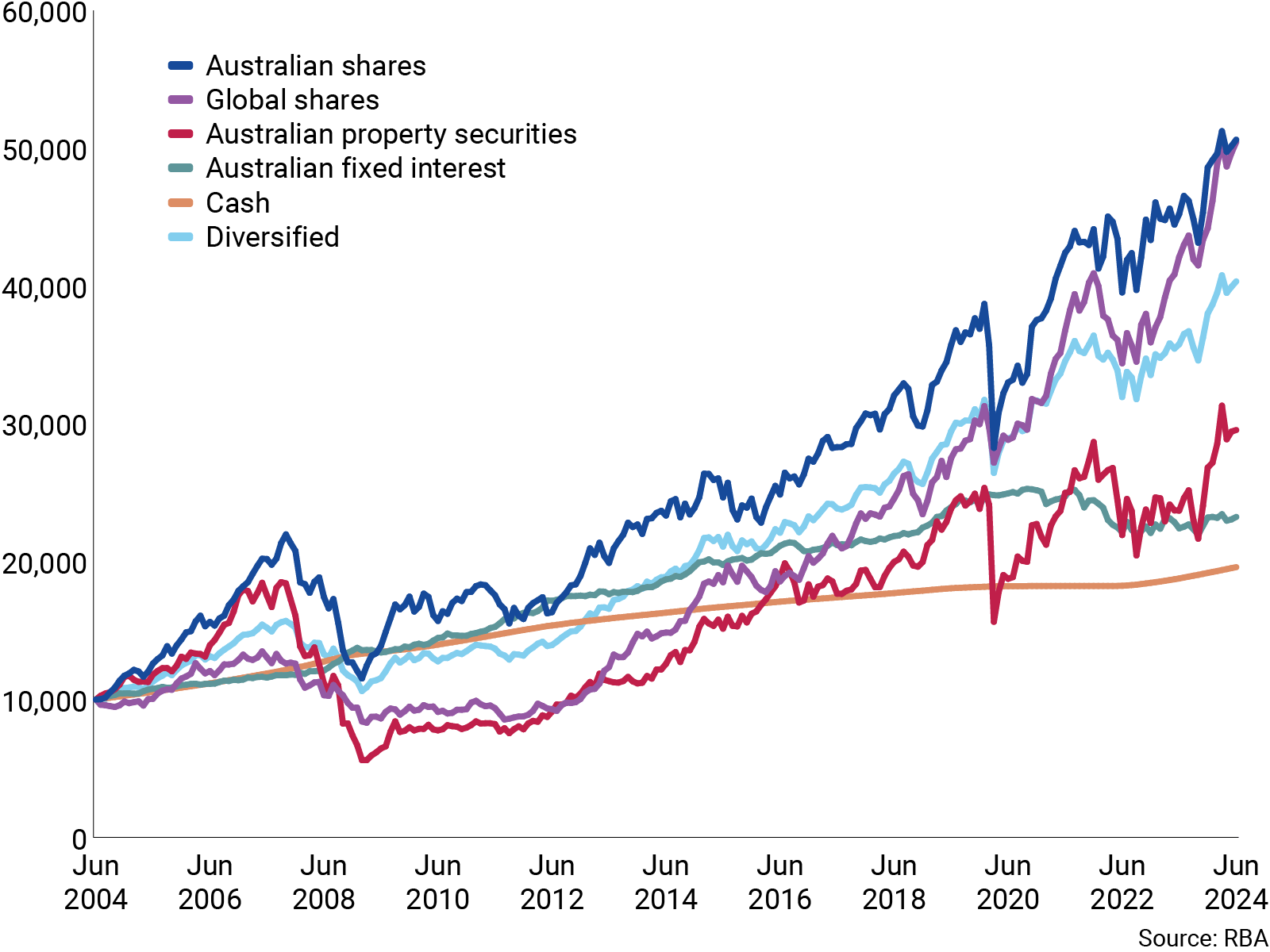

As this chart shows, the long-term trend across major investment types is positive, with shares experiencing more volatility and diversified investments less susceptible to market moves.

Investment category performance over 20 years

The accumulated value of $10,000 invested in each asset type in 2004

How does CFS support super members and investors?

Be assured, we prepare for times like these.

The CFS Investment team is geared to think about the unpredictable and take action to navigate through times of instability.

We monitor key global events and their potential implications, then take mitigating action.

Our Investment team follows a philosophy of diversification and holds significant liquidity to enable us to be responsive in these types of environments. Our active management style also means we can more effectively manage risk.

Do I need to do anything?

There’s nothing you need to do. However, if you are concerned about your investments, speak to your financial adviser. If you do not have a financial adviser, you can use our find an adviser service to locate one near you.

If you have any questions about your super or investments, call us on 13 13 36, Monday to Friday 8:30am – 6pm, Sydney time.

Want to find out more?

During these periods of uncertainty in global financial markets, it’s important to understand market volatility and its potential effect on super andinvestments.

Our easy guide explains the basics and what you need to consider.

You can keep up to date with market developments with our monthly Market Updates.

What’s next?

Risk profile tool

Make an informed decision by understanding how much risk you're willing to take.

Products to consider

Our range of professionally managed funds are an effective way to diversify your super.

Funds and performance

Plan, compare and monitor your investments with our funds and performance tool.

We're here to help

Get in touch

Get in touch with us online or call us 8:30am to 6pm (Sydney time) Monday to Friday.

Find the right advice option

Our dedicated team can help you choose from a range of different financial advice options.

Download mobile app

Track your balance and see your transaction history from anywhere.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.