Suggested Search

Starting a new job or switching your super to CFS?

Here’s the information your employer will need to set up your CFS super account.

You might also need these details if you’re completing forms to do something else with your super, like combining your accounts.

| Super fund | USI | ABN |

|---|---|---|

| FirstChoice Wholesale Personal Super | FSF0511AU | 26 458 298 557 |

| FirstChoice Employer Super | FSF0361AU | 26 458 298 557 |

If you’re unsure what CFS super fund you have, simply log in to your online portal, or open the mobile app to find out.

Generally, FirstChoice Employer Super can only be opened by your employer. FirstChoice Wholesale Personal Super would've been opened by you, or your financial adviser.

For the USI or ABN of all other accounts, including pensions, please see our About Us.

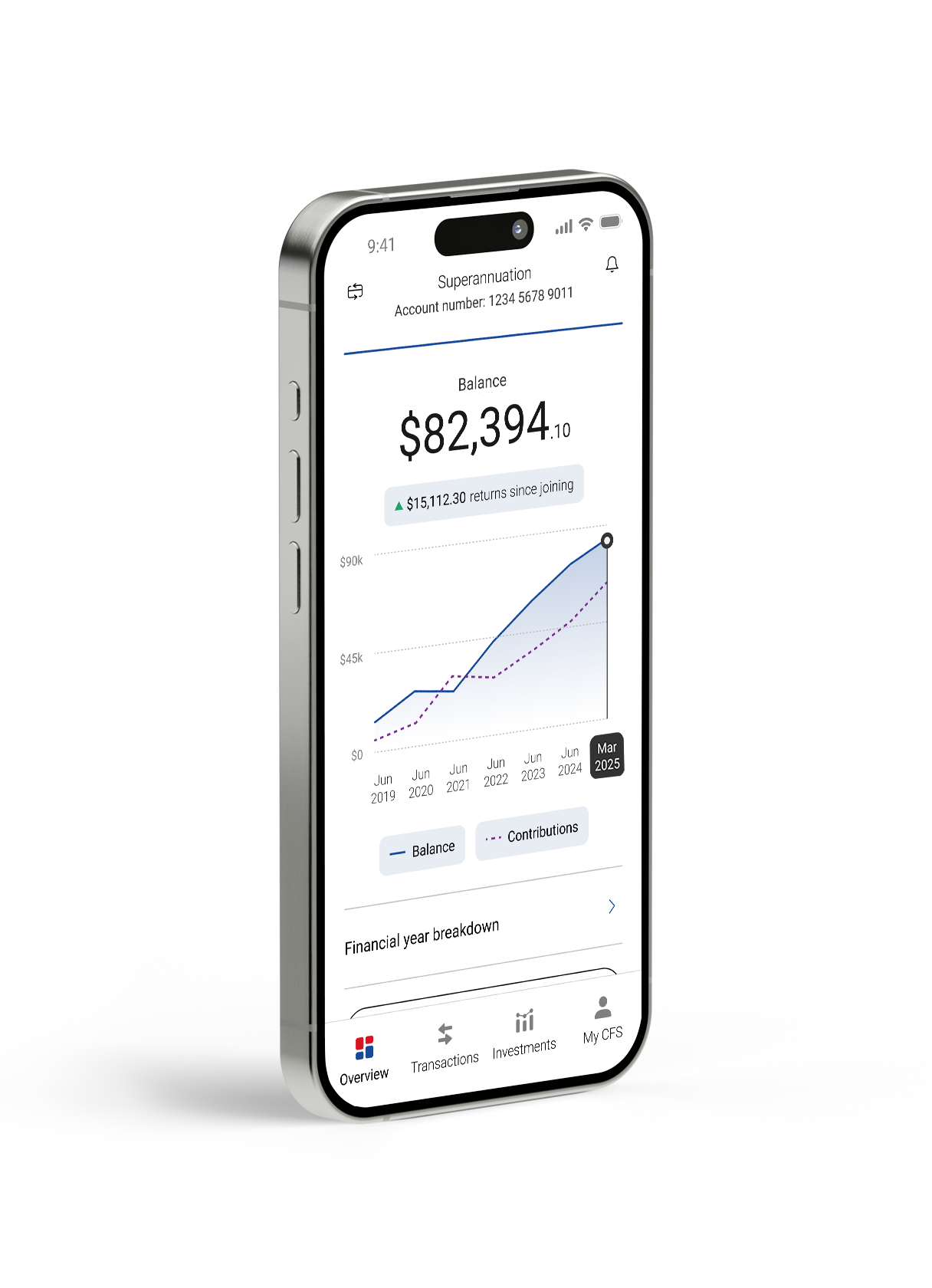

Quickly and easily share your account information with your

employer in our mobile app

- Download the app and login with your Member ID (OIN) and password.

- Tap on “Grow my super”

- Select "Share details with employer" and simply enter your employer's email address so they can start making contributions to your CFS super.

- Track employer super contributions paid to your account and view your investment performance 24/7.

About to start your first job and need a super fund?

When you start your first job, your employer will be required to pay you super. From July 1 2024, this amount is 11.5% of your working wage. Your super earns compound interest and grows over time based on the performance of your super fund.

If you don’t choose a super fund, your employer will set up a default account belonging to the provider they’ve partnered with.

Super is designed to fund your lifestyle when you stop working, so it’s always a good idea to take control of your financial future and choose a super fund which suits your goals, and sets you up for long-term success.

Learn more about our award-winning performance, fees, and customer service today.

What’s next?

How much super

should I have?

Discover how much super you'll need to enjoy the retirement you want, and super-boosting strategies that can help you reach your goals.

Grow your Super

Discover simple strategies to boost your super savings so you can retire with greater financial freedom, security, and purpose.

Combine your Super

Discover how to quickly and easily combine your super accounts to save money, time, and reduce your admin.

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

Past performance is no indication of future performance

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.