A second year of strong returns saw CFS outpace industry and retail super providers despite ongoing volatility over the financial year.

CFS delivered industry leading returns over the year to 30 June 2024 for members of FirstChoice super invested in our balanced and growth options. This marks the second consecutive year that CFS has delivered extraordinary returns for members.

It’s a testament to the CFS Investment team and the disciplined, diversified approach they take to managing unpredictable market conditions.

Headline results for the year ending 30 June 2024 include:

- 14.3% Growth - Lifestage 1975-79 (FirstChoice Employer Super)

- 12.1% Balanced - Lifestage 1965-69 (FirstChoice Employer Super)

- 11.2% CFS Enhanced Index Balanced (FirstChoice Wholesale Personal Super)*

- 12.2% CFS Enhanced Index Growth (FirstChoice Wholesale Personal Super)*

Breaking news: CFS ranked #1

Independent research bodies, SuperRatings and Chant West have released 2023-24 super fund performance scorecards. CFS has been recognised for strong performance including:

- CFS placed #1 and #2 by SuperRatings in the best performing MySuper Lifecycle investment options.**

- Chant West placed CFS equal first in the Top 10 Performing Growth Funds.#

- CFS Enhanced Index Balanced option achieved number three in top fifty balanced options (SuperRatings).**

What contributed to the positive result?

Jonathan Armitage, CFS Chief Investment Officer, said the industry-leading investment performance over the 12 months to 30 June has largely been driven by strong returns in global and domestic equities.

“The strength of global share markets has been the core driver of investment returns over the last 12 months. CFS is also in the unique position of holding no legacy unlisted assets. In an environment of higher interest rates, this has allowed us to deliver another year of solid returns for members,” Armitage said.

While the US share market delivered stand-out returns, our disciplined approach to building diversified portfolios saw the investment team increasing the range of investment return drivers that we have within our portfolios.

Adding private debt to our investment portfolios contributed and will continue to help manage some of the volatility in returns. We also know that volatility can create opportunities, and we have the liquidity built into our portfolios to capitalise on new investment opportunities.

Where to from here?

Inflation data is continuing to be volatile and is of concern to central banks and policymakers. It may be that the market simply has to get used to the fact that the resting heartbeat of inflation is higher than we've become used to.

“Looking ahead, we continue to believe that inflation data will be volatile, keeping interest rates higher for longer and creating continued headwinds for some sectors such as commercial real estate,” said Armitage.

“Managing the evolving macro-economic environment will also be paramount over the coming year and we look forward to again delivering strong returns for members and investors in FY25.”

How the media reported CFS's performance

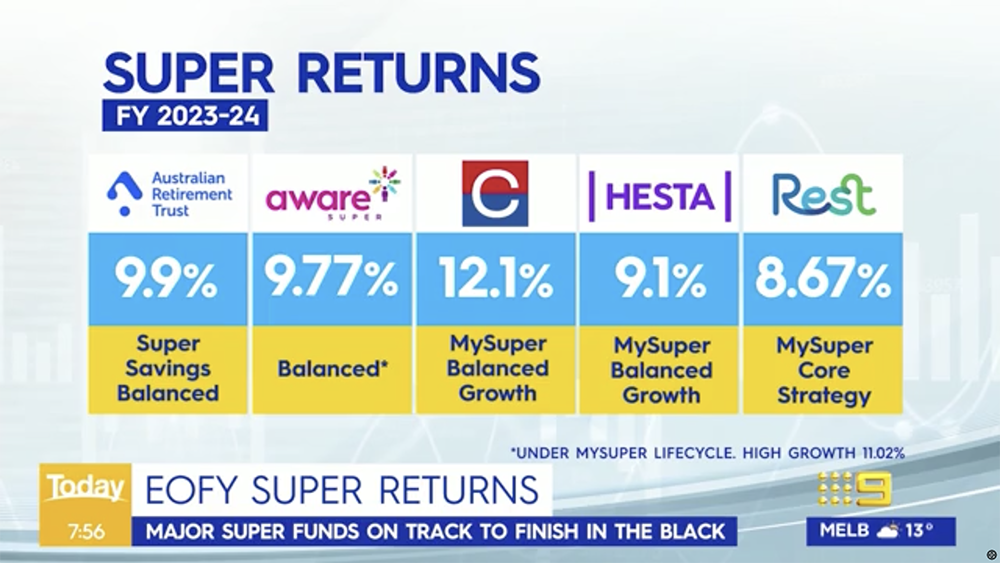

Media reports covering how super funds performed during the financial year 2023-24 confirmed CFS beat industry fund competitors in key categories such as MySuper balanced.

The Australian reported CFS's strong investment returns outstripped big industry fund competitors on the back of our exposure to US tech stocks.

The Australian Financial Review said CFS "outperformed the sector in 2023-24", delivering 12.1 per cent returns for its MySuper balanced option "on the back of soaring technology shares".

Nine's Today Show finance expert Effie Zahos said CFS performed "extremely well" – significantly above the expected Super Ratings median return of 8.8% for balanced funds.

How Nine's Today Show reported CFS's 2023-24 financial year performance against competitors, referencing 12.1% returns for our MySuper Balanced option.

Unleash in ways you never thought possible

Get in touch

For technical enquiries contact us

8:30am – 6pm AEST Monday to Friday.

*Preliminary data for the 12 months to 30 June 2024.

** FirstChoice Essential Super growth option (MySuper Lifestage 1975-79) was the best performing MySuper Lifecycle option in FY24, delivering a 14.4% return, followed by FirstChoice Employer Super growth option (MySuper Lifestage 1975-79), which ranked second with a 14.3% return. As rated by research house SuperRatings.

# Chant West Top 10 Performing Growth Funds (year to June 2024) – CFS FirstChoice Choice Growth returned 10.7% equal to Mine Super and IOOF.

This document provides general information for the adviser only and is not to be handed to any investor. Information on this webpage is provided by Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) and Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL). It may include general advice but does not consider anyone’s individual objectives, financial situation, needs or tax circumstances. You should read the Financial Services Guide (FSG) before making any recommendations to a client. This information is based on current requirements and laws as at the date of publication. Published as at 26 June 2023.