Suggested Search

Streamline your practice and serve clients better with CFS managed account portfolios.

Our broad range of portfolios, all underpinned by a common philosophy, enable you to efficiently and confidently meet diverse client needs.

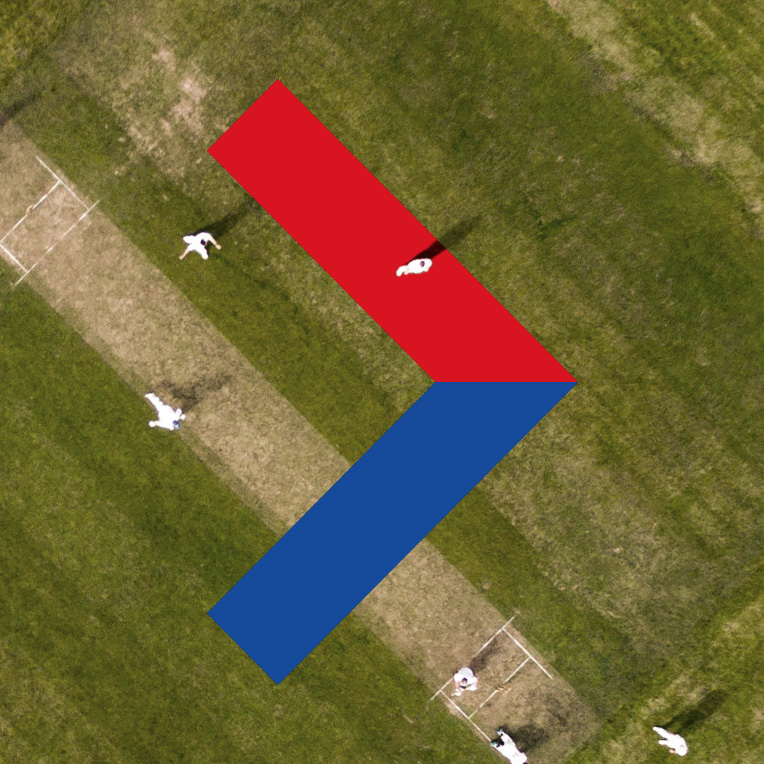

Adviser and Client efficiency

Purpose-built portfolios with common building blocks enable highly-efficient advice journeys.

Depth and Agility

As the velocity of market change increases, so does the importance of our active, agile approach to asset allocation.

Range and Consistency

Our suite of portfolios cater to diverse client types, and are underpinned by a consistent and contemporary investment philosophy.

CFS Apex Portfolio

CFS’s 'best ideas' managed account offers sophistication without complexity.

Unconstrained

The highest level of active management for highly-engaged clients.

Direct shares

Improved transparency and engagement through direct shares.

Focussed

We only spend on fully active managers in asset classes where it makes sense. Savings are passed on to clients.

Tools and resources

CFS Flex Portfolio

Aligns with a preference for using a mix of active and passive.

A better Core-Satellite

Similar cost, but more robust portfolio construction.

Full toolkit

Flexibility to utilise passive, enhanced and active building blocks.

Avoid clunky blending

An off-the-shelf solution that removes the need to blend SMAs, ensuring cohesion and consistency.

Tools and resources

CFS Index Portfolio

A high-quality managed account for fee-sensitive portfolios.

Active asset allocation

Asset mix adapts to constantly evolving market dynamics.

Simple but diversified

Broad market exposure, packaged efficiently.

Cost efficient

Exclusively uses passive building blocks to keep costs down.

Tools and resources

We're here to help

Get in touch

For adviser services contact us 8:30am - 6pm (Sydney time) Monday to Friday.

FirstTech: 9am - 5:30pm Monday to Friday.

Adviser use only

Information on this webpage is provided by Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 and Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468. It may include general advice but does not consider anyone’s individual objectives, financial situation, needs or tax circumstances. You should read the relevant Product Disclosure Statements (PDSs), Investor Directed Portfolio Service Guides (IDPS Guides) and Financial Services Guides (FSGs) before making any recommendations to a client. The PDSs, IDPS Guides and FSGs can be obtained from www.cfs.com.au or by calling us on 13 18 36. Past performance or awards are no indication of future performance.