Suggested Search

Adviser Question:

My client commenced an account based pension on 1 July 2021 for $1.7 million. Then a year later, they made a lump sum withdrawal of $100,000.

When the general transfer balance cap indexed to $1.9 million on 1 July 2023, we were advised that their personal transfer balance cap remained at $1.7 million. Why didn’t they receive at least partial indexation?

Answer:

Clients have their own personal transfer balance cap, which determines the amount they can transfer into retirement phase income streams.

When they first have a transfer balance account (generally when they commence their first retirement phase income stream) their personal transfer balance cap equals the general transfer balance cap at that time. In this client’s case, when they commenced the account based pension on 1 July 2021, the personal transfer balance cap was $1.7 million which equalled the general transfer balance cap at that time.

When the general transfer balance indexed to $1.9 million on 1 July 2023, the ‘proportional indexation’ calculation determined whether a client’s personal transfer balance cap also increased.

Under proportional indexation, a client’s personal transfer balance cap only receives a percentage of the indexation that applies to the general cap, based on the unused portion of their personal cap. This unused portion is calculated with reference to the highest transfer balance account value that the client has ever previously had, and what their personal transfer balance cap was at the earliest time that value occurs.[1]

In this client’s case, their highest transfer balance account value was $1.7 million. The subsequent withdrawal of $100,000 did not impact this value. As a result, the client’s highest transfer balance account of $1.7 million (on 1 July 2021) equalled their personal transfer balance cap at that time of $1.7 million, resulting in an unused portion of zero.

This means the client’s personal transfer balance cap will not increase at any time in the future due to proportional indexation, as their unused personal transfer balance cap amount will always be zero.

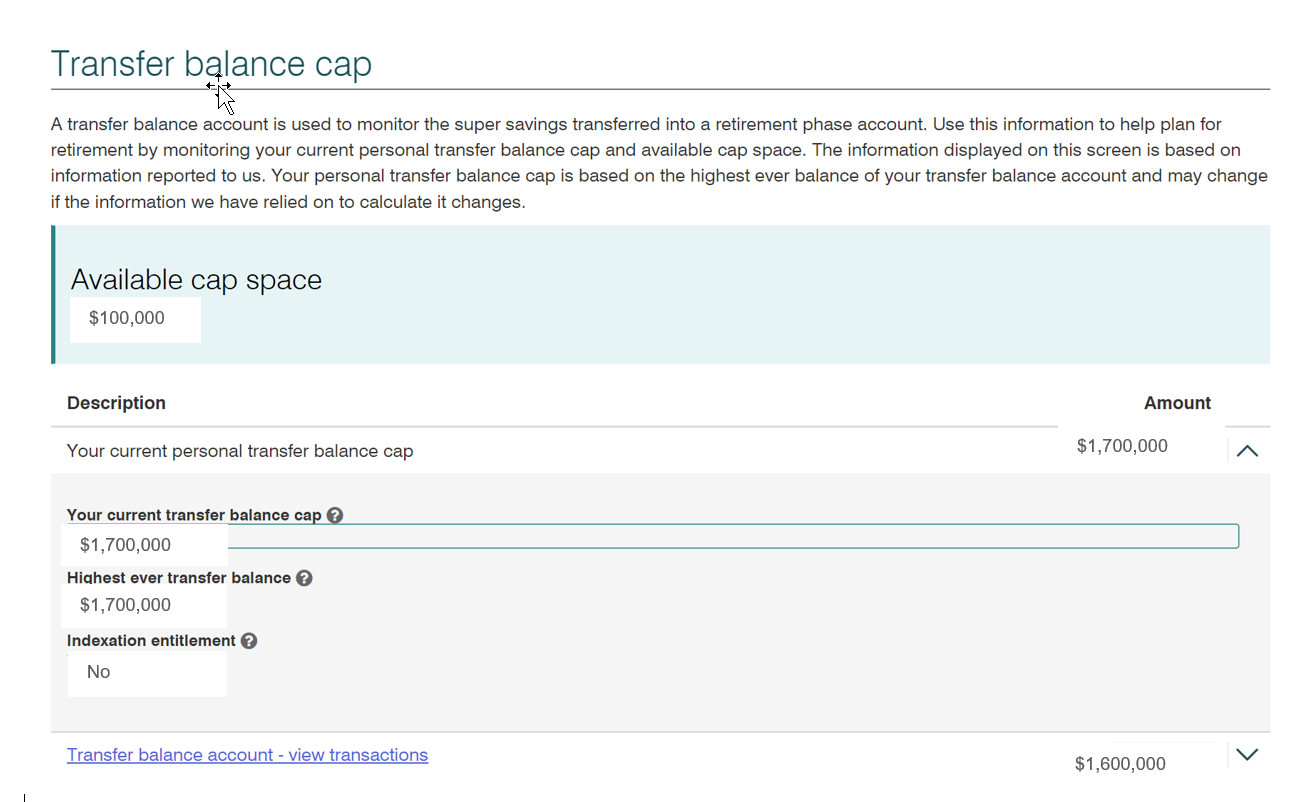

Clients can access their personal transfer balance cap information, including their highest ever transfer balance, via ATO online services through myGov.[1] Below is an example of the information under Super > Information> Transfer balance cap:

For more information on proportional indexation, see page 348 of the FirstTech Super and Retirement Income Streams Guide or the FirstTech article Indexation of the General Transfer Balance Cap from 1 July 2023.

We're here to help

Get in touch

For adviser services contact us 8:30am - 6pm (Sydney time) Monday to Friday.

FirstTech: 9am - 5:30pm Monday to Friday.

Disclaimer

The information contained in this update is based on the understanding Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) and Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) has of the relevant Australian laws as at the article date. As these laws are subject to change you should refer to our website at www.cfs.com.au or talk to a professional adviser for the most up-to-date information. The information is for adviser use only and is not a substitute for investors seeking advice. While all care has been taken in the preparation of this document (using sources believed to be reliable and accurate), no person, including AIL, nor CFSIL, accepts responsibility for any loss suffered by any person arising from reliance on this information. This update is not financial product advice and does not take into account any individual’s objectives, financial situation or needs. Any examples are for illustrative purposes only and actual risks and benefits will vary depending on each investor’s individual circumstances. You should form your own opinion and take your own legal, taxation and financial advice on the application of the information to your business and your clients.

Taxation considerations are general and based on present taxation laws and may be subject to change. You should seek independent, professional tax advice before making any decision based on this information.

AIL and CFSIL are also not a registered tax (financial) adviser under the Tax Agent Services Act 2009 and you should seek tax advice from a registered tax agent or a registered tax (financial) adviser if you intend to rely on this information to satisfy the liabilities or obligations or claim entitlements that arise, or could arise, under a taxation law.