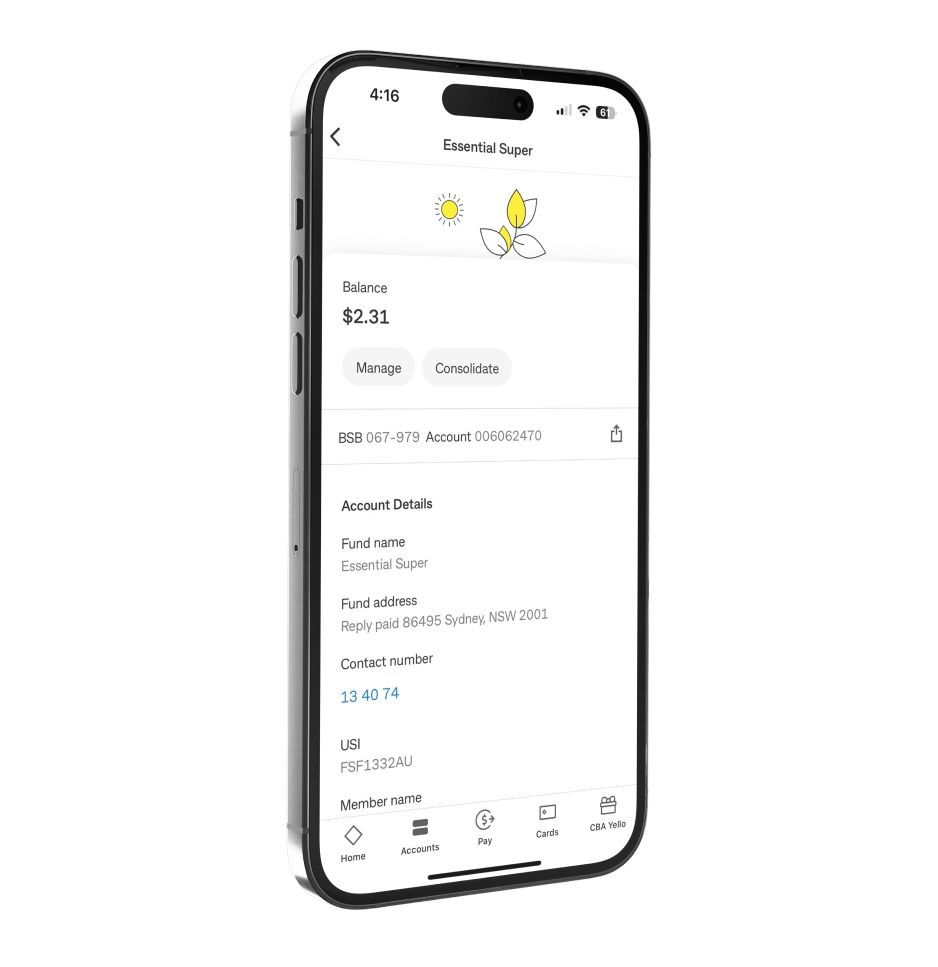

Log on: Simply log on to your Essential Super account via NetBank or the CommBank App and click ‘Consolidate’ or ‘Find your super’

How to combine super accounts

-

-

Verify: We’ll ask you a few verification questions to perform the search for your super. We'll also need to verify your identity so have your Australian driver’s licence, passport, visa or Centrelink and Medicare card handy.

-

Search: We'll use the ATO's SuperMatch service to search for any lost or other super you may have.

-

Combine: If we find any super under your name, you can combine your super accounts with a click of a button.

Why combine multiple super accounts?

Keep your hard-earned dollars

Stop multiple account fees from draining your balance. Combine your super into a single fund to pay less on admin and keep your savings invested.

Maximise your super investment

With less money spent on fees and more staying in your super, you'll have a bigger base to benefit from strong performance.

Stay in control of your super

It's easy to keep track of a single Essential Super account. See your super and day-to-day funds in one place via NetBank or the CommBank app.

Things to check before you combine your super

Make sure the account you're keeping has enough cover to meet your needs. You can check which insurances are attached to your Essential Super account through Netbank or the CommBank app.

If they’re currently going to an account you want to close, you’ll need to let your employer know where they should go from now on. Need to bring your super to your Essential Super account? Use the Essential Super - Super Choice form.

You’ll need to change any salary sacrifice or automatic payments so they go into the super account you’re keeping open. Speak to your employer or bank to sort this out.

There may be additional things to consider if you have an SMSF or defined benefit fund. Make sure you understand the implications before combining your super.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (referred to as Colonial First State, CFS, ‘we’, ‘us’ or ‘our’) is the Trustee of Essential Super ABN 56 601 925 435 and the issuer of interests in Essential Super. Essential Super is distributed by the Commonwealth Bank of Australia ABN 48 123 123 124, AFSL 234945 (the Bank). The CFS Group consists of Superannuation and Investments HoldCo Pty Limited ABN 64 644 660 882 (HoldCo) and its subsidiaries, which includes CFS. The Bank holds an interest in the CFS Group through its significant minority interest in HoldCo.

This information is issued by CFS and may include general financial product advice but does not consider your individual objectives, financial situation, needs or tax circumstances, and so you should consider the appropriateness of the advice having regard to your circumstances before acting on it. The Target Market Determination (TMD) for Essential Super can be found at cfs.com.au/tmd and includes a description of who the financial product is appropriate for and any conditions on how the product can be distributed to customers. You should read the Product Disclosure Statement (PDS) and the Reference Guides for Essential Super carefully and consider whether the information is appropriate for you before making any decision regarding this product. Download the PDS and Reference Guides at commbank.com.au/essentialsuper-documents or call us on 13 4074 for a copy. None of the Bank, HoldCo, CFS, nor any of their respective subsidiaries guarantee the performance of Essential Super or the repayment of capital by Essential Super. An investment in this product is subject to risk, loss of income and capital invested. An investment in Essential Super is via a superannuation trust and is therefore not an investment in, deposit with or other liability of the Bank or its subsidiaries.

The insurance provider is AIA Australia Limited ABN 79 004 837 861, AFSL 230043 (AIA Australia). AIA Australia is not part of the Commonwealth Bank Group or CFS. Insurance cover is provided to eligible members of Essential Super under policies issued to CFS.